San Francisco — “Trickle-down economics has never worked, and it’s time to grow the economy from the bottom and the middle out”. These are not the words of a radical leftist (although it likely would be), but of President Biden. In his recent joint address to Congress, President Biden hammered home the importance of taxing the wealthy their fair share.

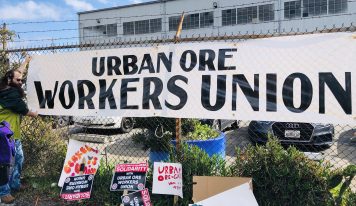

Mayor Breed announced her budget via live-stream on YouTube and other streaming channels, on the 1st of June. The Mayor’s speech made no mention of how her office plans to allocate PropI funds, which passed with a 15-point margin in November. Prop I was supported by the majority of the Board of Supervisors and by a variety of political organizations like the Democratic Socialists of America (DSA). Supervisor Dean Preston, who found this to be concerning, said, “It’s really astonishing that the mayor would not fully fund the promises of Prop I … the Board of Supervisors must step in to ensure these efforts are fully funded”. Mayor Breed has not released her proposed budget in writing.

In an article by the SF Chronicle, Preston also said the following:

“I don’t think it was a mystery to anyone that these were funds for COVID rent relief and social housing. It’s really astonishing that given that budget reality, the mayor would not specifically and unequivocally propose a budget that would fully fund the promises of Prop. I … The need has only grown since the voters voted for it, so to be denying rent relief to people right now is unconscionable.”

In a city like San Francisco, this call for the wealthiest in our country to pay their fair share has been amplified in local policies like Prop I. Prop I is estimated to generate $64 million in revenue by the City Controller’s office, and the funds are expected to be used for COVID rent relief and social housing. The projection from the City Controller is that the City will need upwards of $400 million in rent relief. In early May, the local Democrat Party of San Francisco also voted in unison to agree with Prop I and the remarks of President Biden during.

Prop I doubled the sales tax on real estate sales that will cost over $10 million. This is not a tax that will affect the average real-estate sale in San Francisco. In fact, it will not even affect most above-average home sales. The median listing home price in San Francisco, CA was $1.3 million in April 2021, according to realtor.com. The tax focuses its increases on the costliest of property transactions, which almost always involves corporations — not individuals — on either side of the deal. This places the burden solely on those involved in the transaction, i.e. those corporations and high net worth individuals who could afford such a tax, unlike an income tax which takes money away from workers on top of the excess profit extracted by their bosses.

Prop I and its proposed changes on property transfer (sale) taxes

The mayor’s spokesperson, Jeff Cretan, was quoted in the SF Chronicle saying that the funds will go to the general fund, which would allow those funds to be spent on police rather than housing or COVID relief. Cretan added the allocation of the funds is a “conversation for the budget process”, signaling that the Mayor’s office believes these voter-approved funds to be a bargaining chip in negotiations with the Board rather than their duty as public servants to implement.